The Texas real estate market continued its evolution toward greater balance in May, with inventory surges across all major metropolitan areas creating the most buyer-favorable conditions since 2016. While underlying economic fundamentals remain solid and consumer spending holds steady despite political volatility, the housing market shows clear signs of normalization from the seller-dominated environment of recent years. Days on market have extended across all regions, and close-to-list ratios indicate growing buyer negotiating power.

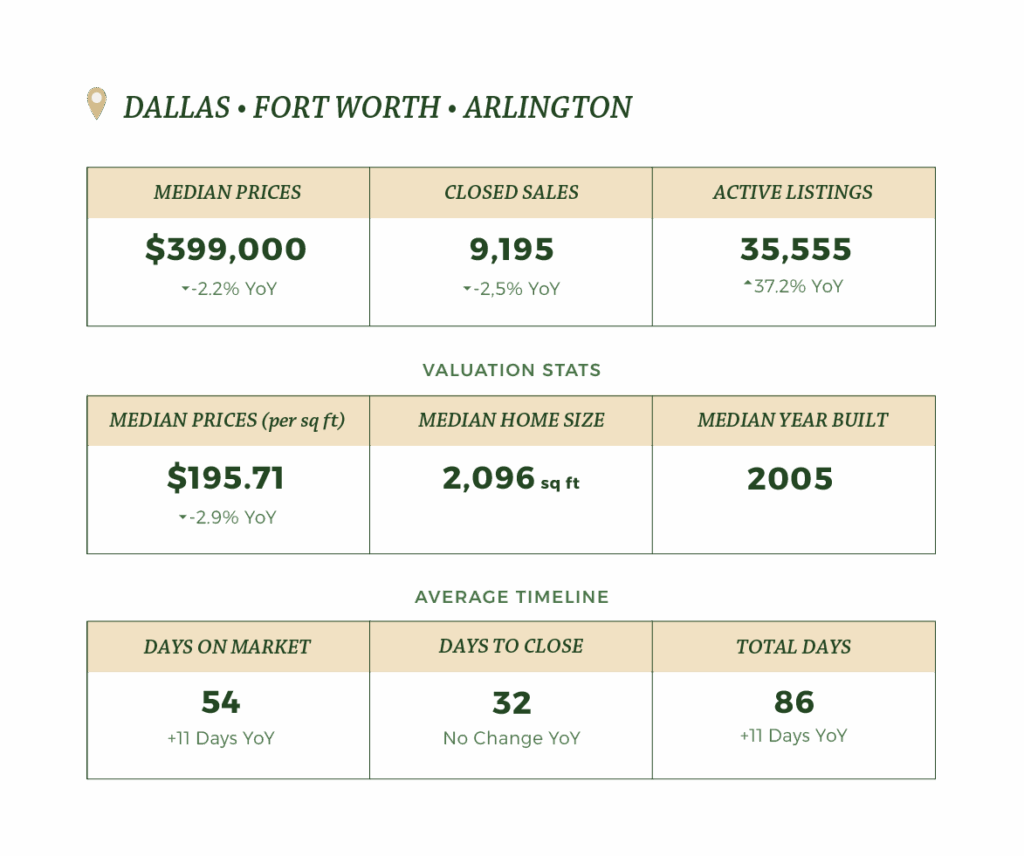

Dallas • Fort Worth • Arlington

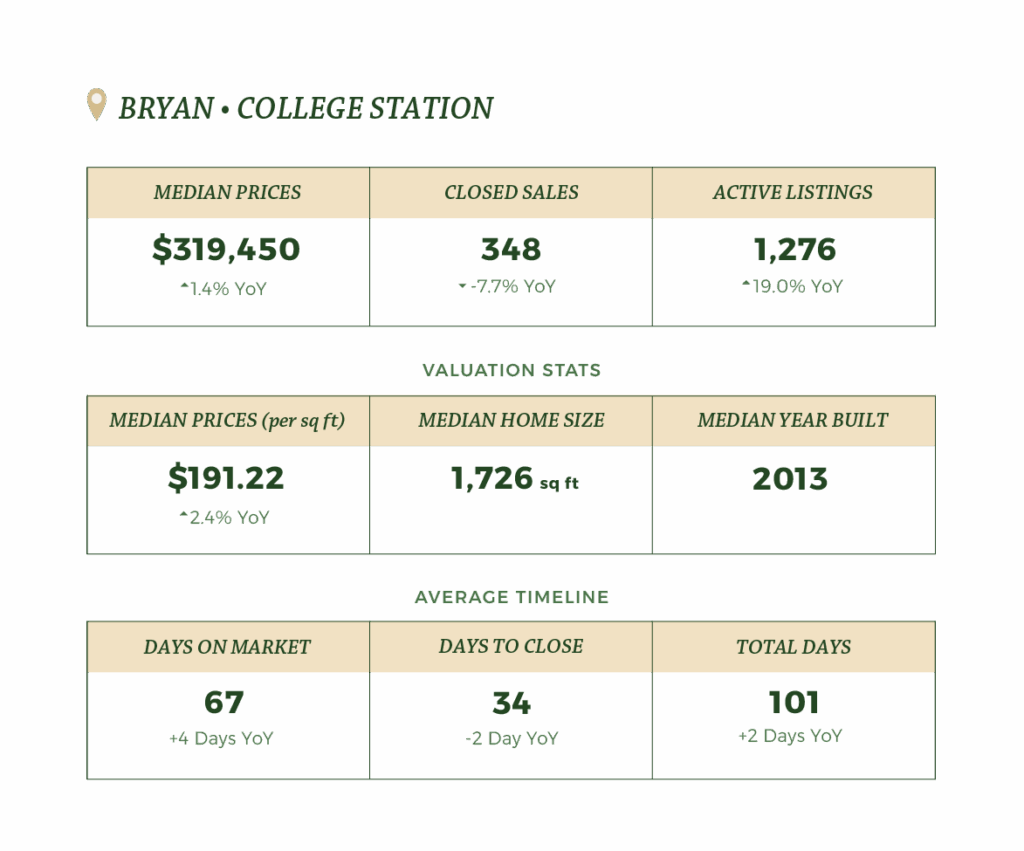

College Station • Bryan

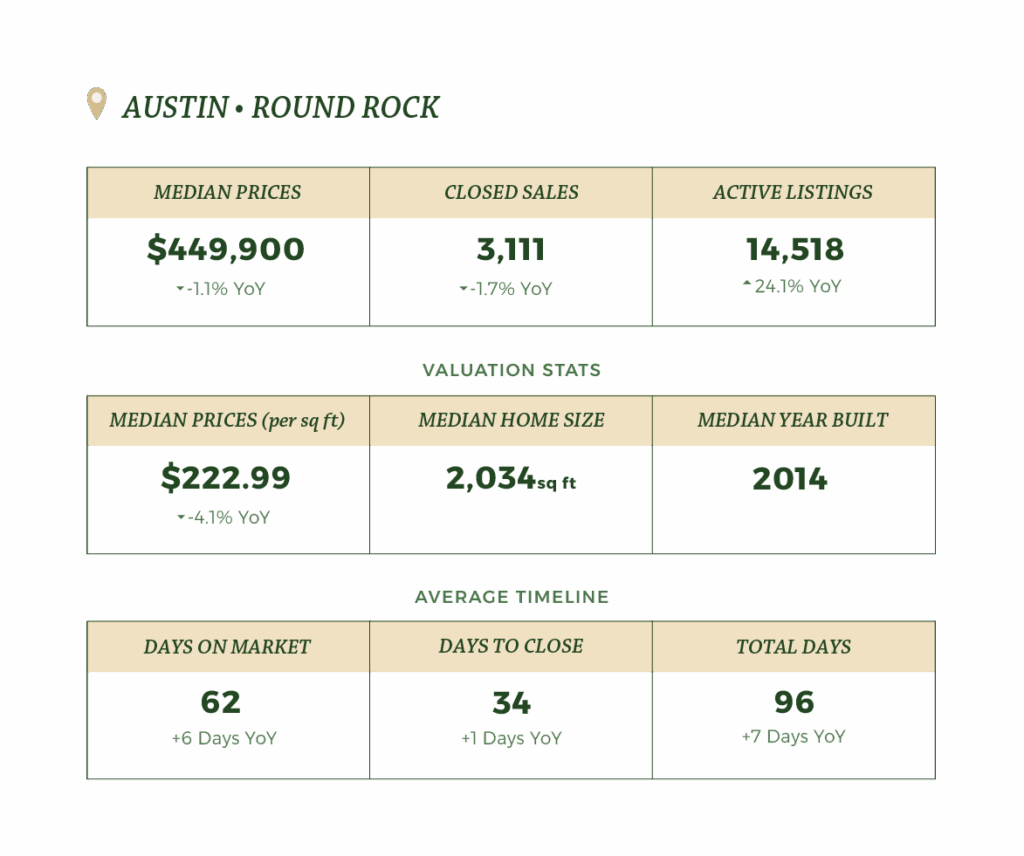

Austin • Round Rock

Houston • The Woodlands • Sugarland

Dallas-Fort Worth-Arlington MSA

The Dallas-Fort Worth market shows continued softening with median prices declining 2.2% year-over-year to $399,000. Active listings have surged 37.2%, reaching levels not seen since the post-2008 period and creating substantial buyer choice. The closed sales decline of 2.5% reflects more selective buyer behavior, though market fundamentals remain strong with nearly half of all sales (46%) occurring in the $200K-$399K range. Days on market increased by 11 days to 54 total, while the close-to-original list ratio of 95.5% indicates sellers are becoming more flexible on pricing.

College Station-Bryan MSA

The university-anchored market maintains relative price stability with modest 1.4% appreciation to $319,450, making it the only major metro showing price growth. However, sales volumes reflect broader cooling trends with closed sales down 7.7% despite the supportive academic calendar. Active listings increased 19.0% to 1,276 homes, while days on market reached 67 days. The close-to-original list ratio of 97.1% remains the strongest among all metros, indicating less pricing pressure than in larger markets.

Austin-Round Rock-San Marcos MSA

Austin’s premium market adjustment continues with median prices declining 1.1% to $449,900. The market shows the most pronounced cooling among major metros, with the longest days on market at 62 days (up 8 days from 2024) and inventory expanding to 5.8 months supply. Despite a 24.1% increase in active listings – the most measured of the major metros – closed sales declined only 1.7%. The concentration in higher price tiers remains notable, with 41% of sales above $500K, reflecting the market’s premium positioning and continued tech sector employment strength.

Houston-Pasadena-The Woodlands MSA

Houston demonstrates the most balanced performance among major metros, with sales actually increasing 5.2% year-over-year despite a massive 36.7% expansion in active listings to 37,970 homes. The median price shows a modest decline of 1.7% to $338,000, while inventory has reached 5.3 months supply. The energy sector’s stability continues to support housing demand, though the dramatic inventory surge signals a clear shift from recent seller-market conditions. Properties now take 50 days on market, up 5 days from last year.

Market Outlook

Several key factors are shaping the current Texas real estate landscape:

-

- Inventory Normalization: All major markets show substantial increases in available listings (19-37% YoY), shifting negotiating leverage toward buyers for the first time since the pandemic recovery.

- Economic Resilience: Despite political volatility creating confidence headwinds, underlying fundamentals remain supportive with stable employment levels and continued population growth across Texas markets.

- Transaction Dynamics: Extended marketing times (83-101 total days) and improving buyer negotiation positions signal a return to more normal market conditions after years of compressed timelines.

- Technology Impact: Accelerating AI adoption across industries, including real estate processes, may create efficiency gains that help offset transaction friction during this market adjustment period.

- Regional Differentiation: Performance varies significantly by metro, with Houston showing sales growth while Austin experiences the most pronounced cooling, requiring location-specific strategies rather than broad-market approaches.

The Texas real estate market appears to be successfully transitioning from an unsustainable seller’s market to more balanced conditions. While price trajectories vary by region, the overall trend toward equilibrium benefits both buyers and sellers by creating a healthier, more predictable market environment. Consumer resilience suggests any economic impact from current political uncertainty may manifest with a lag, providing a buffer for real estate markets during this normalization period.

Learn More

The Texas Real Estate Research Center is a valuable resource for real estate professionals, investors, and anyone interested in learning more about the Texas real estate market.