June brought a surprising turn in the Texas real estate narrative. While May pointed toward continued cooling, the latest data reveals a more nuanced picture. Inventory levels continued rising as expected, but buyer activity also surged—producing an unexpectedly active month that defies simplistic “hot” or “cold” labels. Rather than signs of volatility, this trend signals a maturing market finding its footing.

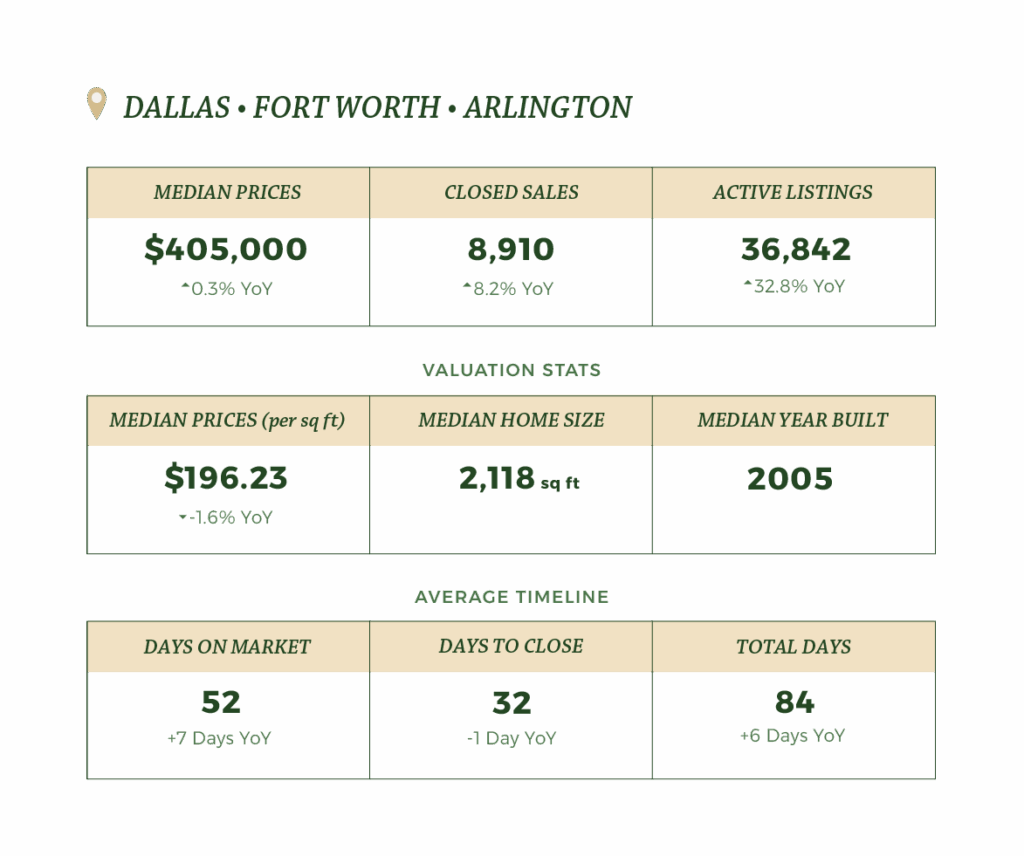

Dallas • Fort Worth • Arlington

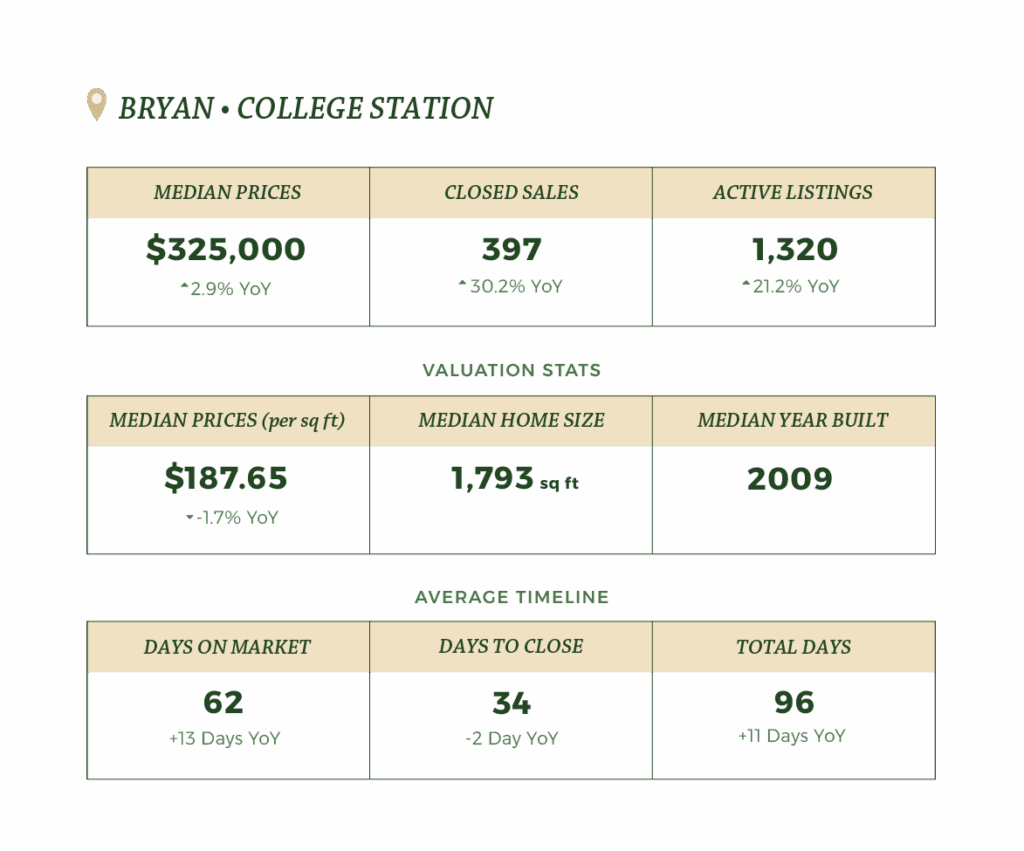

College Station • Bryan

Austin • Round Rock

Houston • The Woodlands • Sugarland

Dallas-Fort Worth-Arlington MSA

DFW staged a notable rebound in June. After a 2.2% price decline in May, the median home price ticked back up to $405,000—marking a 0.3% year-over-year gain. The real story was sales volume: 8,910 closed transactions, up 8.2% from last year. This surge helped absorb much of the 32.8% jump in inventory, now totaling 36,842 active listings. Days on market improved slightly to 52, and sellers maintained pricing power with a 95.4% close-to-list ratio. Expanded inventory appears to have unlocked latent demand.

College Station-Bryan MSA

This university-driven market emerged as a breakout performer. The median price rose 2.9% to $325,000, while closed sales surged 30.2% year-over-year to 397 transactions. While inventory expanded 21.2% and days on market rose to 62, the strong sales growth reflects solid absorption rather than stagnation. A 96.5% close-to-list ratio confirms that buyer interest remains high and pricing discipline is intact.

Austin-Round Rock-San Marcos MSA

Austin continues its deliberate recalibration. The median price declined 0.8% to $445,000, a modest correction that aligns with a “soft landing” rather than a broader retreat. Encouragingly, sales increased 7.5% to 3,006 transactions even as inventory rose 22.4%. The 65-day average on market and a 93.7% close-to-list ratio reflect shifting leverage toward buyers—without undermining seller confidence. The region’s fundamentals, particularly in tech and in-migration, remain strong.

Houston-Pasadena-The Woodlands MSA

Houston delivered the strongest month in terms of raw volume. Closed sales surged 10.4% year-over-year to 8,561 transactions, while the median price dipped only slightly—down 0.4% to $345,000. Inventory rose 33.4% to 39,185 active listings, yet the market absorbed this growth efficiently. Days on market held steady at 48, reinforcing Houston’s reputation as a resilient, demand-driven market supported by energy sector stability and steady in-migration.

Market Outlook

The June data challenges assumptions about Texas real estate’s trajectory and paints a picture of increasing market maturity:

-

- The Inventory Paradox: Year-over-year inventory gains of 21–33% were expected, but strong buyer engagement was not. Expanded choice appears to be unlocking previously sidelined demand.

- Fundamentals > Headlines: June’s across-the-board sales gains reinforce that local economic strength—job growth, wage stability, and in-migration—continues to drive housing demand.

- Extended Timelines, Healthy Function: Average time from listing to close now ranges from 82–99 days. But in the context of strong sales growth, this reflects more deliberate decision-making rather than market friction.

- Diverging Regional Dynamics: Houston’s energy economy, Austin’s tech base, and College Station’s academic influence are creating increasingly distinct market behaviors. Texas isn’t one market—it’s a diverse ecosystem.

June suggests the Texas housing market is not cooling—it’s evolving. Buyers are acting with more strategy, and sellers are adjusting to new norms without panic. This shift toward sustainable, high-volume function at elevated inventory levels is a hallmark of a more resilient, mature market.

Learn More

The Texas Real Estate Research Center is a valuable resource for real estate professionals, investors, and anyone interested in learning more about the Texas real estate market.