As we close out 2024, let’s analyze the December real estate market trends across key Texas regions: Austin/Round Rock, College Station/Bryan, Dallas/Fort Worth/Arlington, and Sugar Land/Houston/The Woodlands. This month’s report offers valuable insights into year-end market dynamics, providing crucial data for buyers, sellers, and investors planning their 2025 real estate strategies.

All markets are showing signs of normalization with increasing inventory levels and moderate price appreciation, while still maintaining strong sales momentum. The substantial Texas migration surplus of over 3,000 people continues to drive demand across these major metropolitan areas, though each market shows distinct characteristics in how this demand manifests in local market conditions.

Dallas • Fort Worth • Arlington

College Station • Bryan

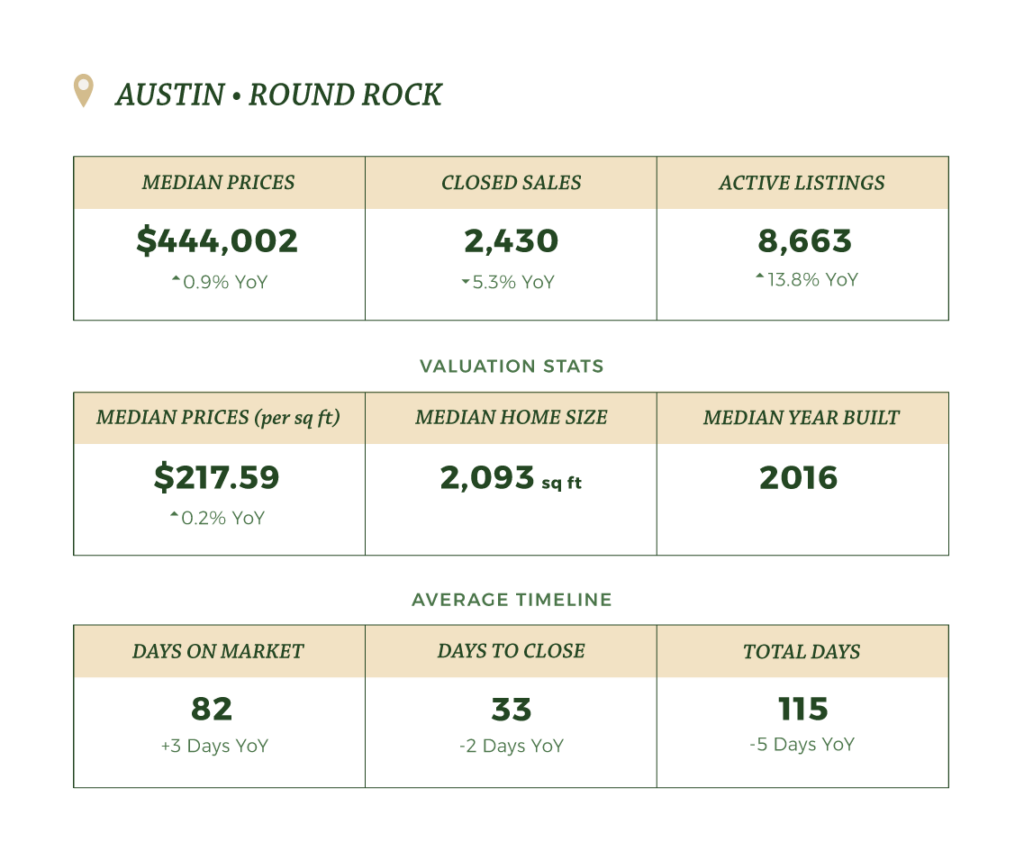

Austin • Round Rock

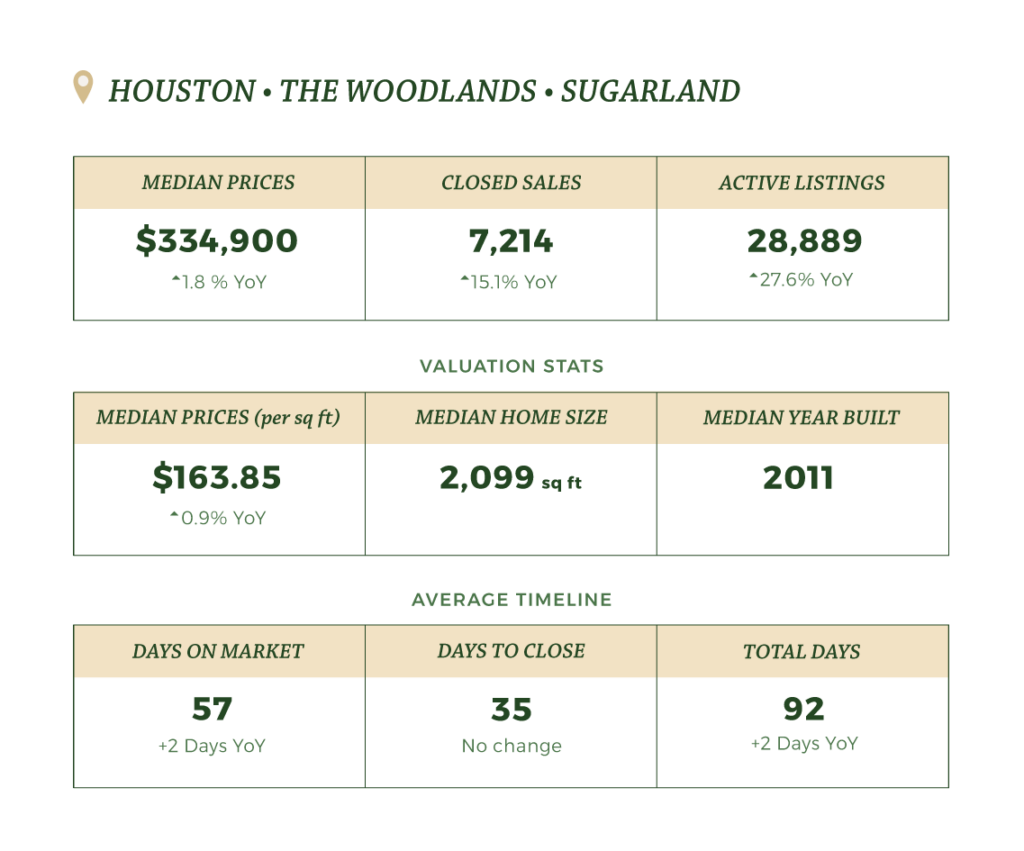

Houston • The Woodlands • Sugarland

The DFW market showed robust sales activity with moderate price growth in December 2024. The median home price reached $400,000, up 2.6% year-over-year. Closed sales increased significantly by 15.2% to 7,364 transactions. Active listings showed substantial growth, up 33.1% to 24,973 properties. As one of Texas’s primary destinations for new residents, DFW continues to benefit from the state’s strong migration surplus. The market had 3.3 months of inventory, up 0.8 months from last year. Properties spent 65 days on market, 9 days longer than December 2023, and the median price per square foot remained relatively stable at $192.98 (+0.3% YoY).

Bryan/College Station showed strong growth across all metrics in December 2024. The median home price increased significantly to $322,500, up 9.1% year-over-year. Closed sales jumped 23.2% to 266 transactions, while active listings grew by 27.3% to 1,041 properties. The market had 3.9 months of inventory, up 0.8 months from last year. The continued state-wide population growth appears to be benefiting College Station’s market, particularly given its role as an educational hub. Properties took longer to sell compared to 2023, with days on market increasing by 17 days to 85 days. The median price per square foot showed healthy appreciation at $187.05 (+4.1% YoY).

The Austin market showed modest growth in December 2024, with median home prices reaching $444,002, up 0.9% year-over-year. The market saw 2,430 closed sales, representing a 5.3% increase from the previous year. Active listings grew by 13.8% to 8,663 properties, indicating expanding inventory. With Texas experiencing a significant migration surplus of over 3,000 people, Austin’s position as a major tech hub continues to attract new residents. The market had 3.4 months of inventory, up 0.4 months from last year. Homes spent an average of 82 days on market, slightly faster than December 2023, and the median price per square foot held relatively stable at $217.59 (+0.2% YoY).

Houston’s market demonstrated strong sales volume growth with moderate price appreciation in December 2024. The median home price reached $334,900, up 1.8% year-over-year. Closed sales increased significantly by 15.1% to 7,214 transactions. Active listings grew substantially by 27.6% to 28,889 properties. The strong Texas migration patterns appear to be supporting Houston’s robust market activity. The market showed 4.0 months of inventory, up 0.9 months from last year. Properties spent 57 days on market, slightly longer than 2023, while the median price per square foot increased modestly to $163.85 (+0.9% YoY).

Learn More

The Texas Real Estate Research Center is a valuable resource for real estate professionals, investors, and anyone interested in learning more about the Texas real estate market.