The Texas real estate market continues to evolve with distinct regional patterns emerging across the state’s major metropolitan areas. April data reveals increasing inventory levels across all markets, creating more balanced conditions between buyers and sellers. Days on market have extended in all regions compared to last year, indicating a normalization from the frenzied pace of previous years.

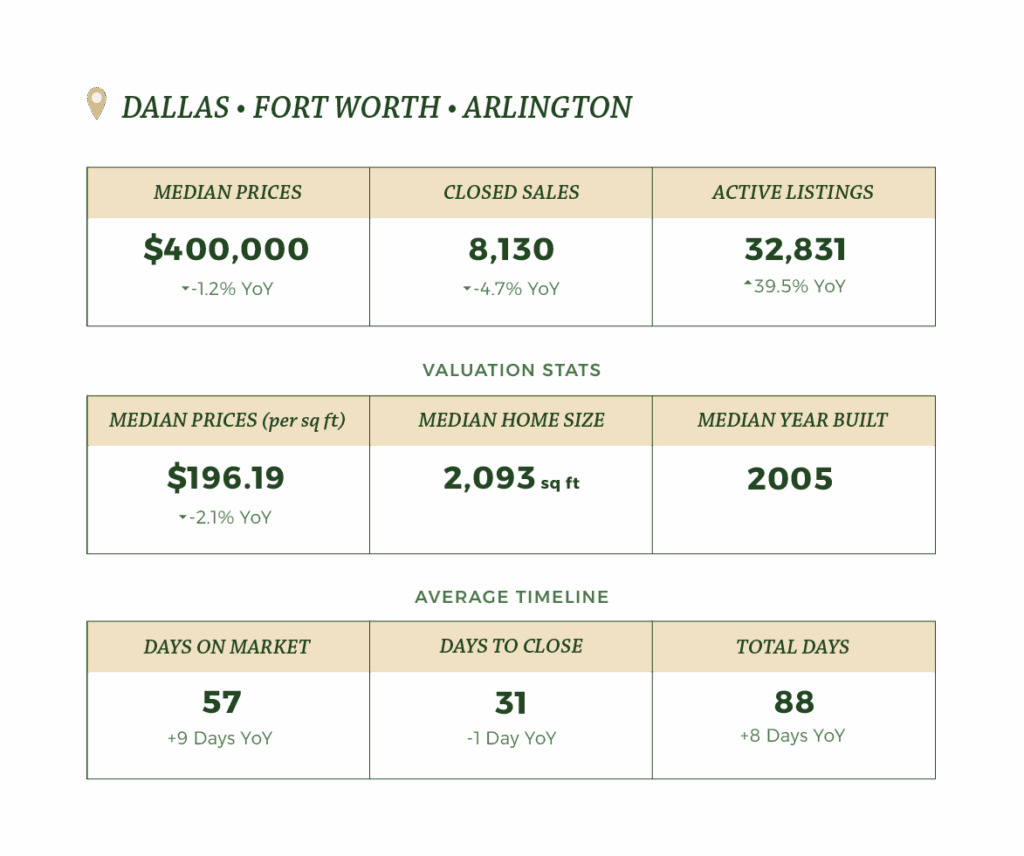

Dallas • Fort Worth • Arlington

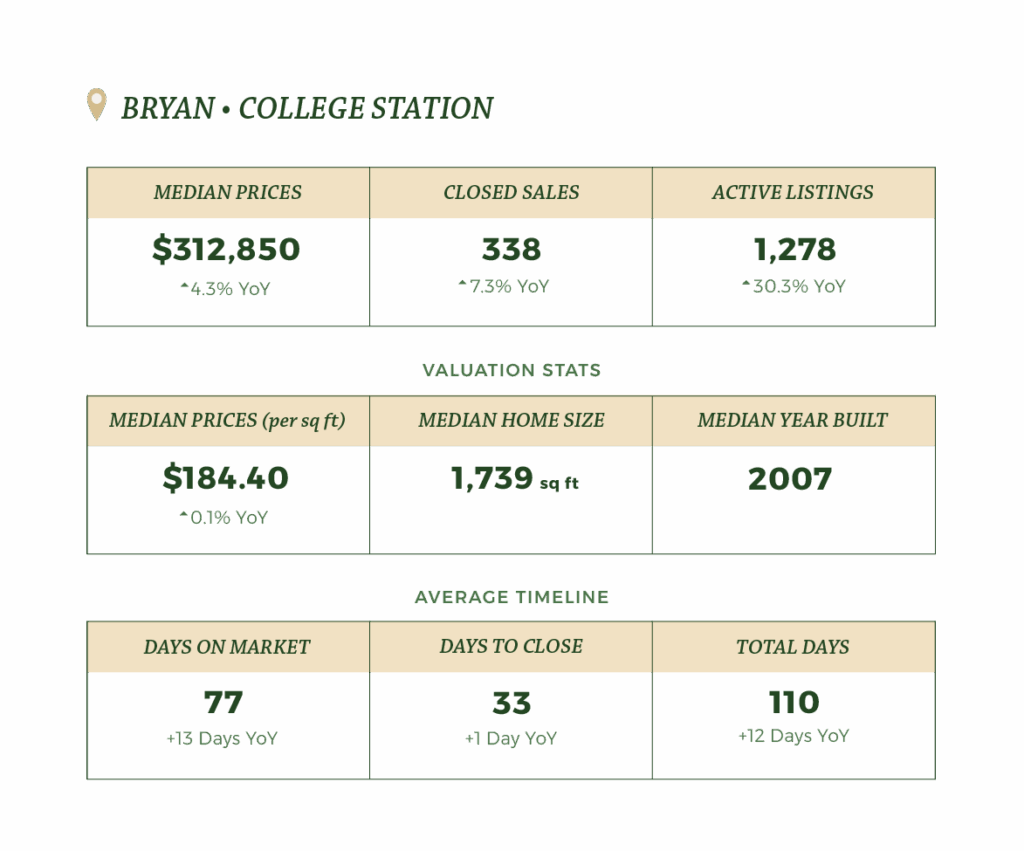

College Station • Bryan

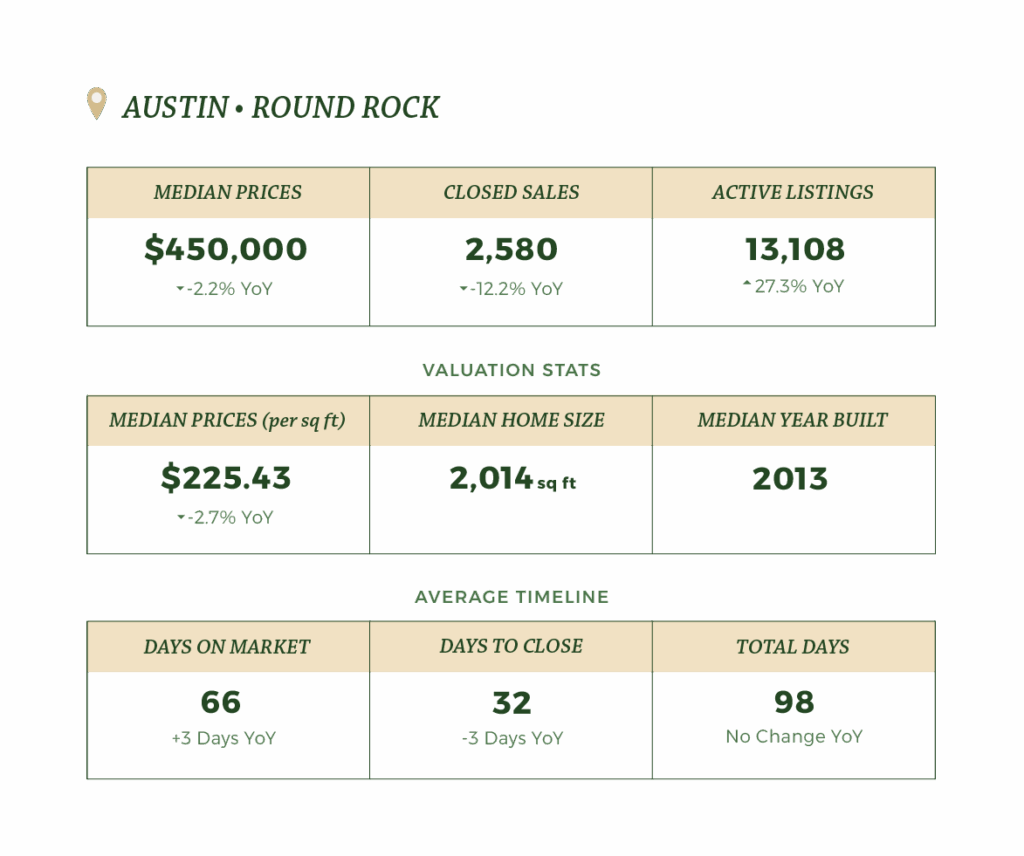

Austin • Round Rock

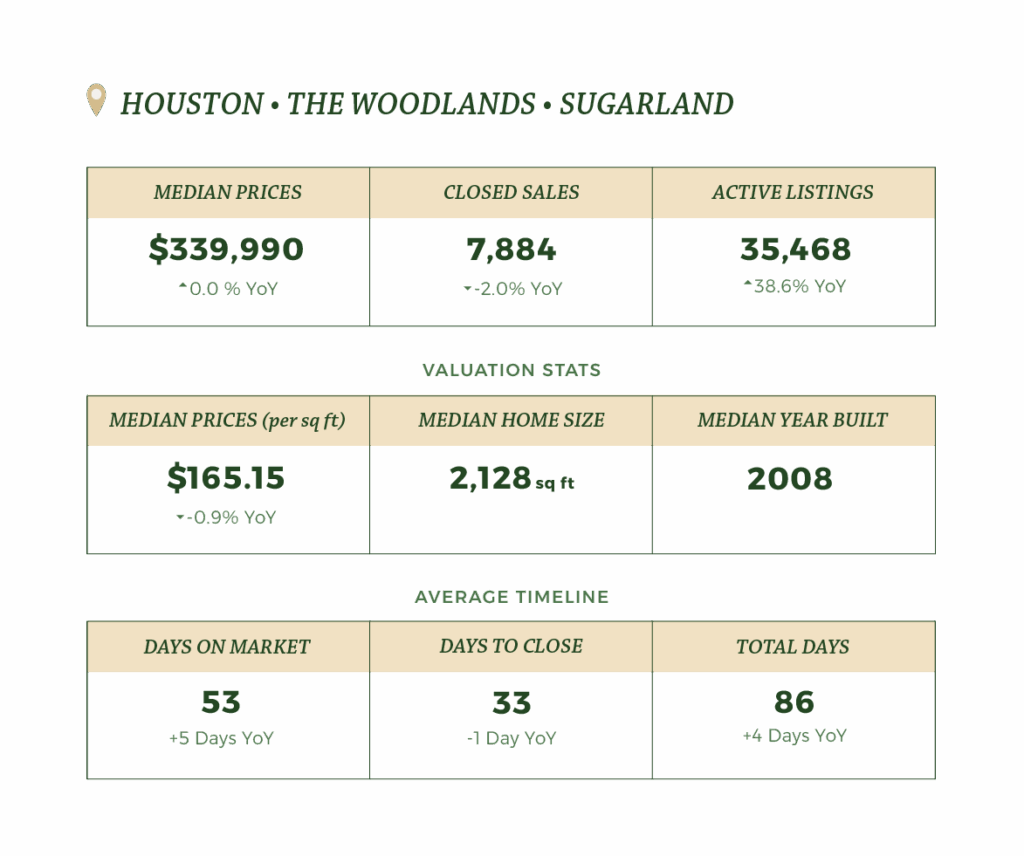

Houston • The Woodlands • Sugarland

Dallas-Fort Worth-Arlington MSA

The Dallas-Fort Worth market shows modest price adjustment with median values declining 1.2% year-over-year to $400,000. Active listings have surged 39.5%, creating more options for buyers than at any point in the past three years. The closed sales decline of 4.7% reflects more selective buyer behavior amid expanding inventory and higher financing costs, though the market fundamentals remain strong with balanced distribution across price segments.

College Station-Bryan MSA

College Station continues to demonstrate remarkable price resilience with a 4.3% year-over-year increase in median home prices to $312,850. This growth occurred despite a significant 30.3% expansion in active listings. The market shows notably strong transaction volume with closed sales up 7.3%, indicating robust demand fundamentals in this university-anchored economy. However, properties now take considerably longer to sell, with total market time extending to 110 days – 13 days more than April 2024.

Austin-Round Rock-San Marcos MSA

Austin’s market correction continues with median prices declining 2.2% compared to last year, settling at $450,000. The market shows clear signs of cooling with closed sales down 12.2% despite inventory levels expanding to 5.2 months. The significant concentration of properties in the $300K-$750K range (68.3% of all listings) indicates the market’s adjustment toward more sustainable price points following years of exceptional appreciation.

Houston-Pasadena-The Woodlands MSA

The Houston metropolitan area shows price stabilization with the median home price holding steady at $339,990 compared to April 2024. What’s most notable is the substantial 38.6% increase in active listings, bringing inventory levels to 4.9 months – the highest since before the pandemic. The slight decline in closed sales (-2.0%) reflects more selective buyer behavior in this balanced market environment.

Market Outlook

Several factors are influencing the current real estate landscape in Texas:

- Inventory Expansion: All major markets show substantial increases in available listings, shifting negotiating leverage incrementally toward buyers.

- Economic Policy Uncertainty: Recent tariff implementations and resulting market uncertainty are influencing mortgage rates, which remain in the upper 6% range despite Federal Reserve rate adjustments.

- Population Growth: Texas continues to outpace the national average with a 1.8% population growth rate in 2024, providing fundamental support for housing demand despite short-term market adjustments.

- Extended Marketing Timelines: Properties are taking longer to sell across all regions, requiring sellers to adjust pricing strategies and expectations accordingly.

- Regional Variations: Market performance shows greater differentiation by region than at any point since the pandemic, requiring location-specific approaches rather than broad-market strategies.

The Texas real estate market appears to be entering a period of sustainable equilibrium after years of exceptional volatility. While price trajectories vary by region, the overall trend toward more balanced conditions benefits both buyers and sellers by creating a healthier, more predictable market environment.

Learn More

The Texas Real Estate Research Center is a valuable resource for real estate professionals, investors, and anyone interested in learning more about the Texas real estate market.