Housing Supply:

- Texas housing supply has increased by 16% year-over-year

- Current inventory stands at approximately 5 months of supply across the state

Demand:

- Demand for Texas housing has decreased by 3.7% compared to last year

- Price reductions on active listings remain consistent with the previous year

- Properties are selling for approximately 97% of the asking price

Migration:

- Net positive, with over 4,000 more people looking to move into Texas out of the state

Economic Outlook:

- Further rate cuts may be necessary to significantly boost economic activity

- Markets display optimism about the overall economic trajectory

- The economy shows resilience, though growth is not particularly strong

- Recent 50 basis point rate cut was beneficial but not transformative

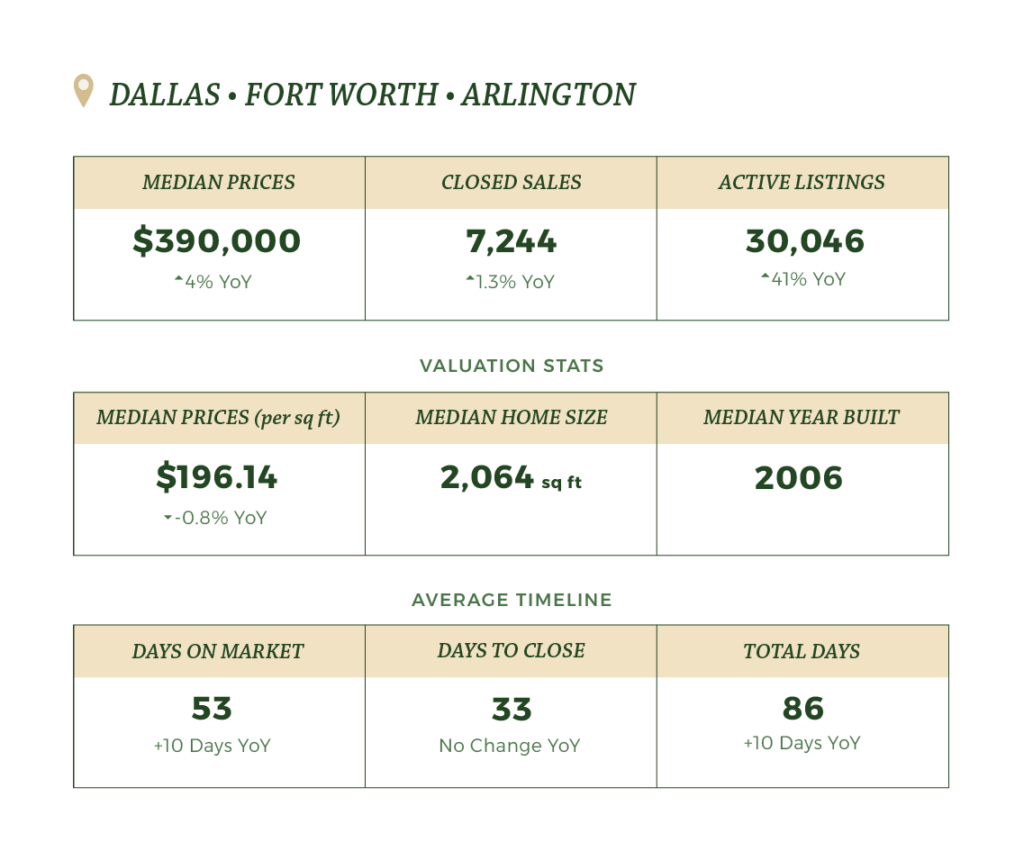

Dallas • Fort Worth • Arlington

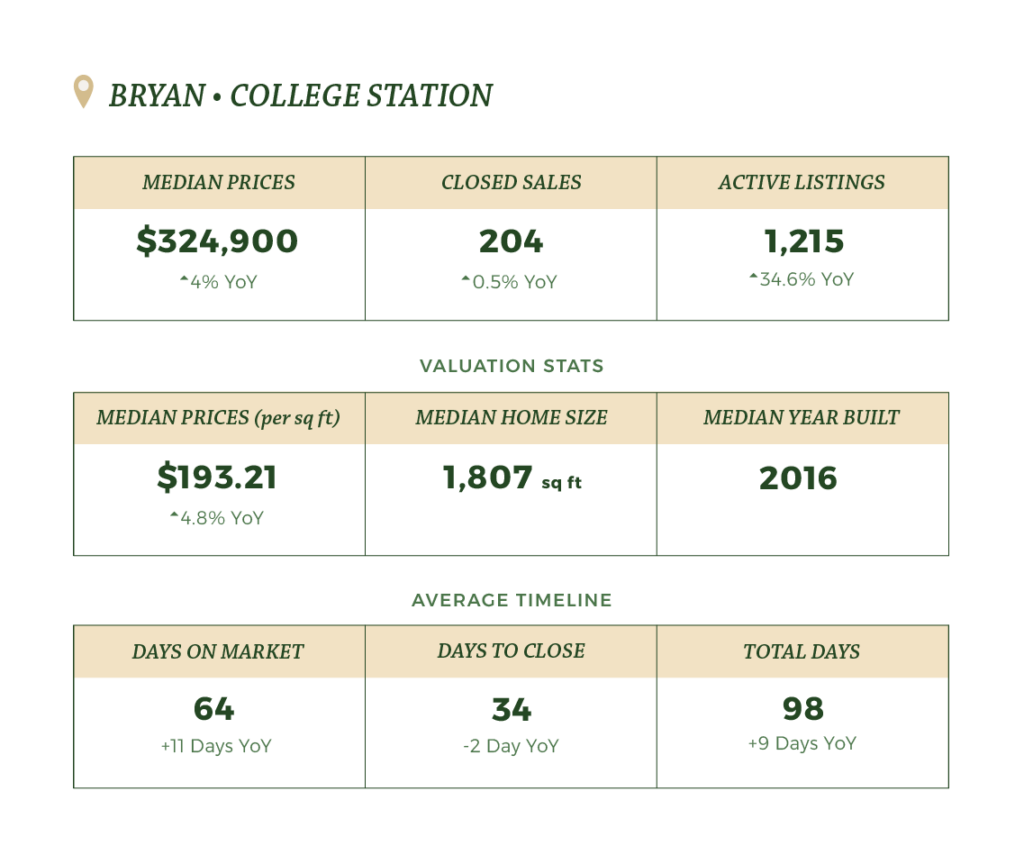

College Station • Bryan

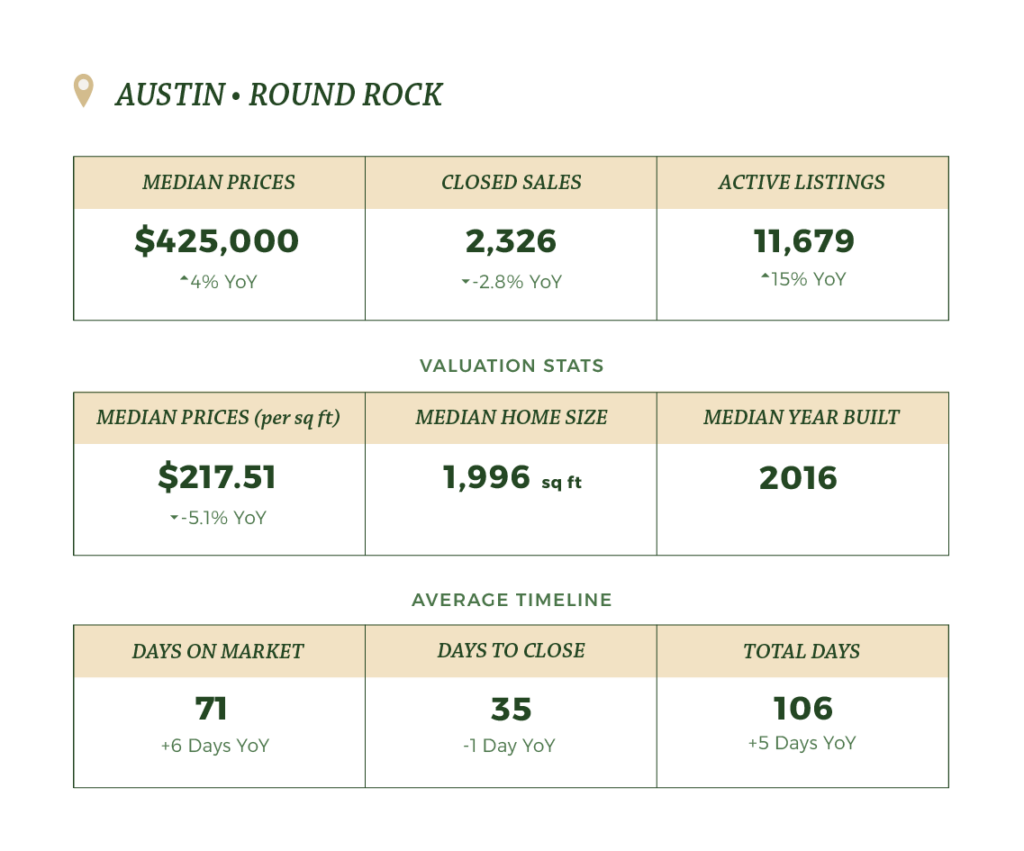

Austin • Round Rock

Houston • The Woodlands • Sugarland

Learn More

The Texas Real Estate Research Center is a valuable resource for real estate professionals, investors, and anyone interested in learning more about the Texas real estate market.