Key Statewide Themes

1. Inventory Is Back

Months of inventory now hover between 4.8 and 5.9 across major metros, the most balanced levels in years. This shift is giving buyers more options and more negotiating room.

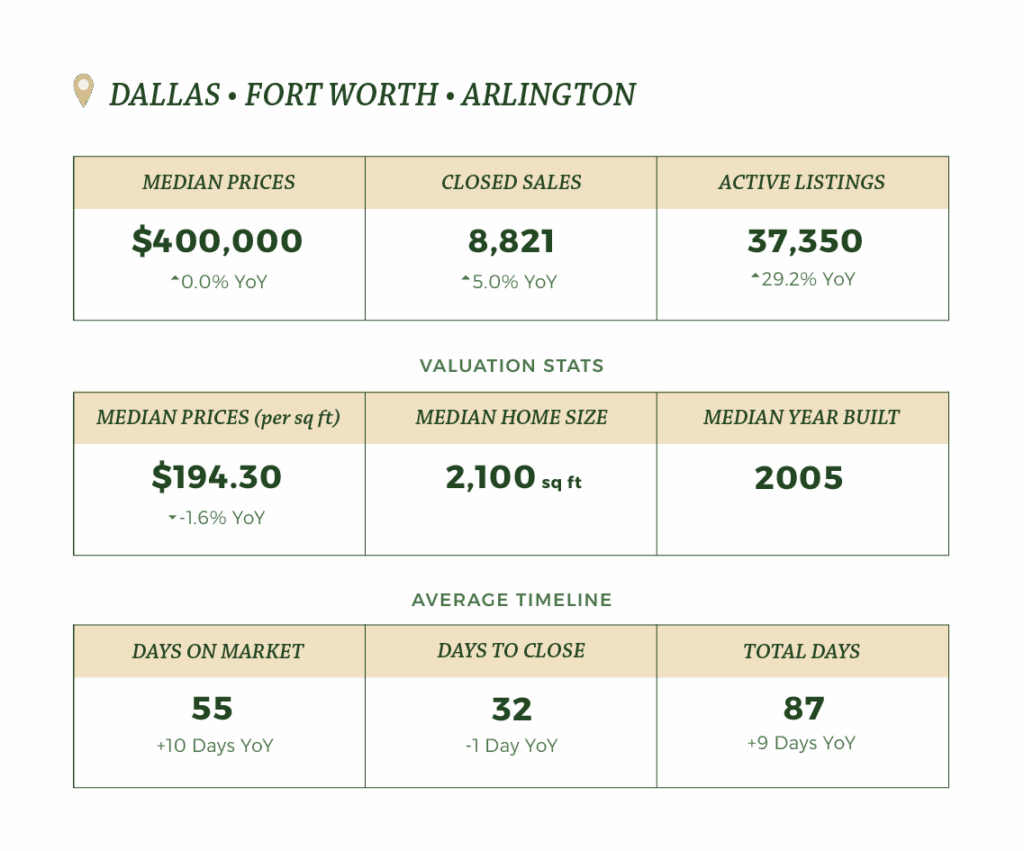

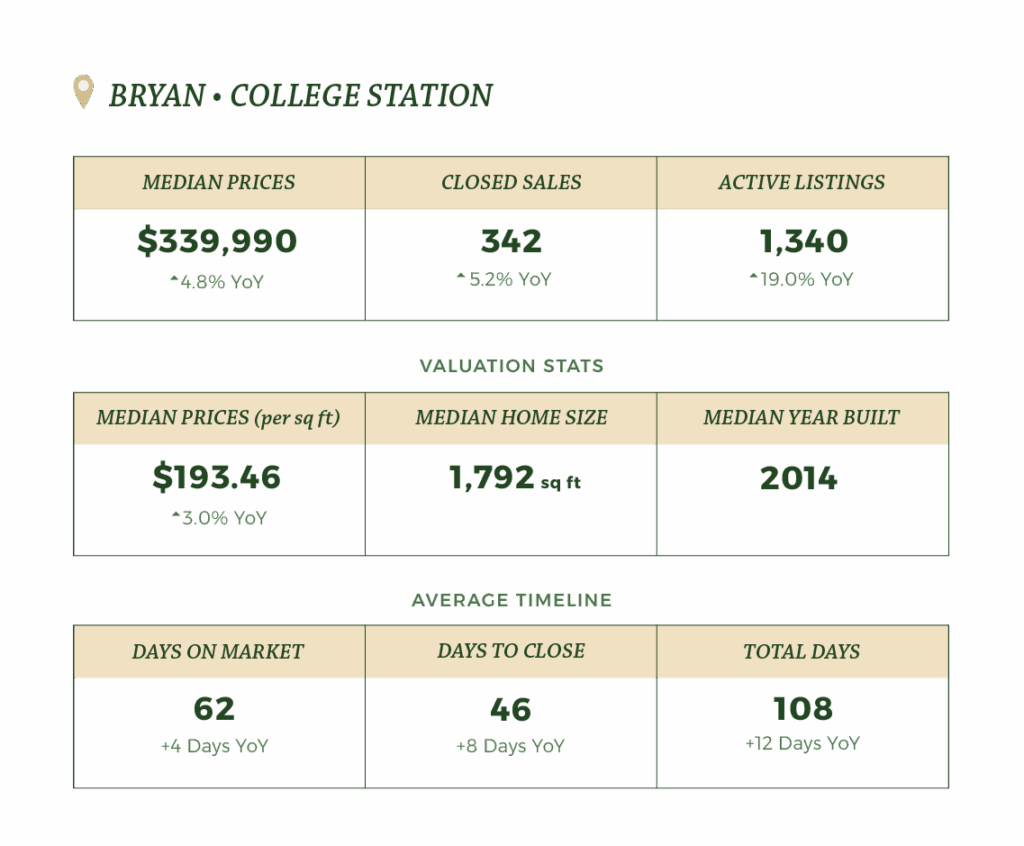

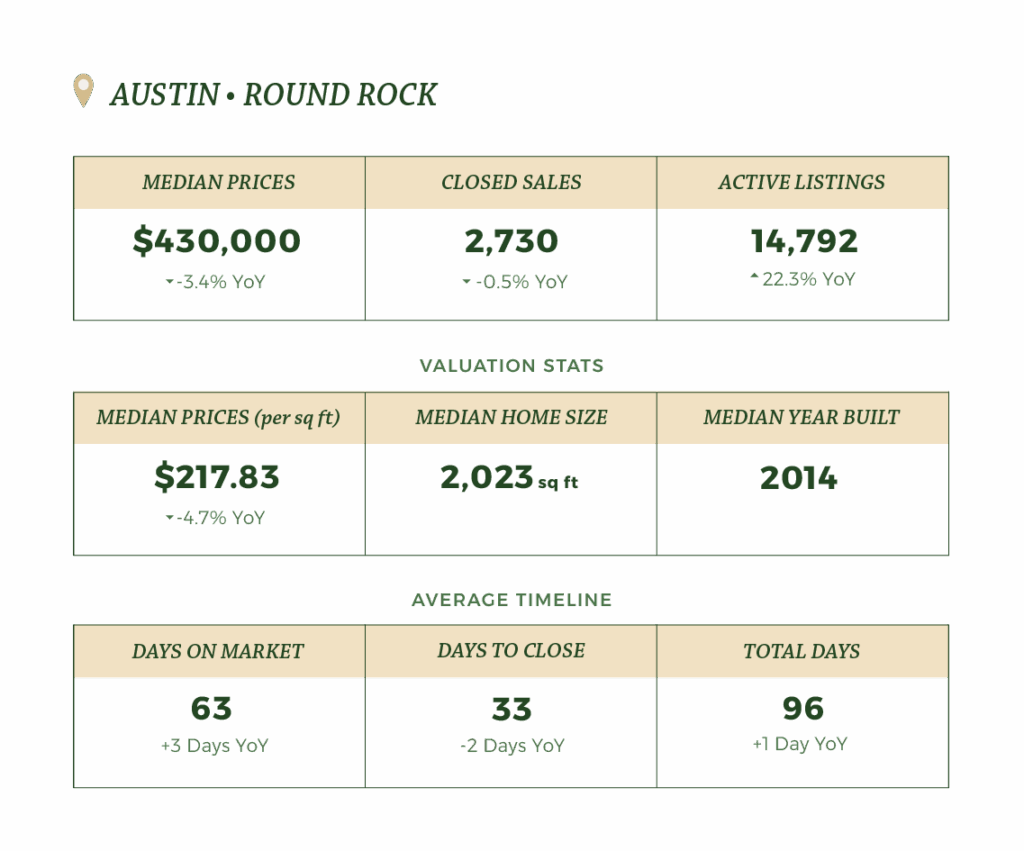

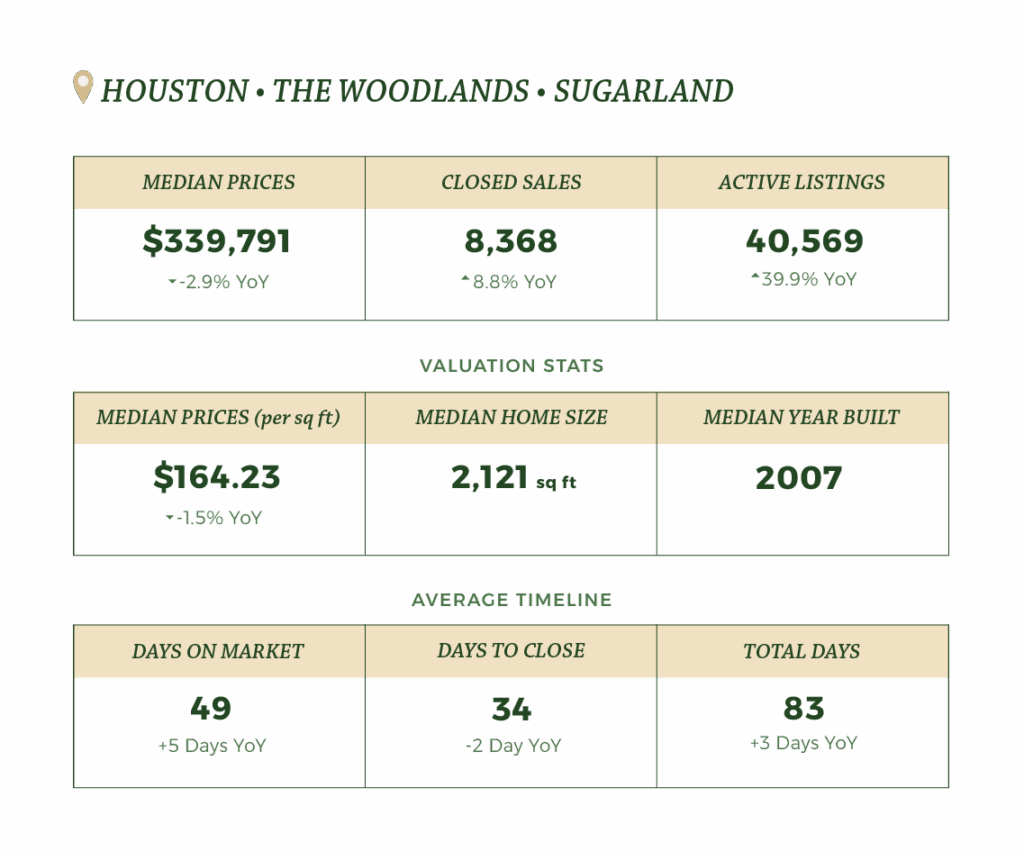

2. Price Growth Has Stalled — or Reversed

Median prices are flat in Dallas–Fort Worth, down modestly in Austin and Houston, and still climbing in College Station–Bryan. The modest corrections in larger metros point to a market finding its true value after pandemic-era surges.

3. Buyers Are in the Driver’s Seat — but Demand Is Steady

Even with higher supply, closed sales are up in most markets. This signals that demand is still there — buyers just have the time and leverage to be more selective.

4. Longer Timelines, More Negotiation

Days on market are up by 3–10 days year-over-year in most areas, and homes are selling for 93–96% of original list price. Pricing strategy matters more than ever.

Dallas • Fort Worth • Arlington

College Station • Bryan

Austin • Round Rock

Houston • The Woodlands • Sugarland

Dallas-Fort Worth-Arlington MSA

College Station-Bryan MSA

Austin-Round Rock-San Marcos MSA

Houston-Pasadena-The Woodlands MSA

What This Means

For Buyers: More selection and negotiating power than in years, but still enough competition to keep desirable properties moving quickly.

For Sellers: Pricing realistically is crucial, overpricing risks sitting on the market as buyers have more options.

For Investors: Expanding inventory and softening prices in larger metros present buying opportunities, especially for long-term holds.

Learn More

The Texas Real Estate Research Center is a valuable resource for real estate professionals, investors, and anyone interested in learning more about the Texas real estate market.