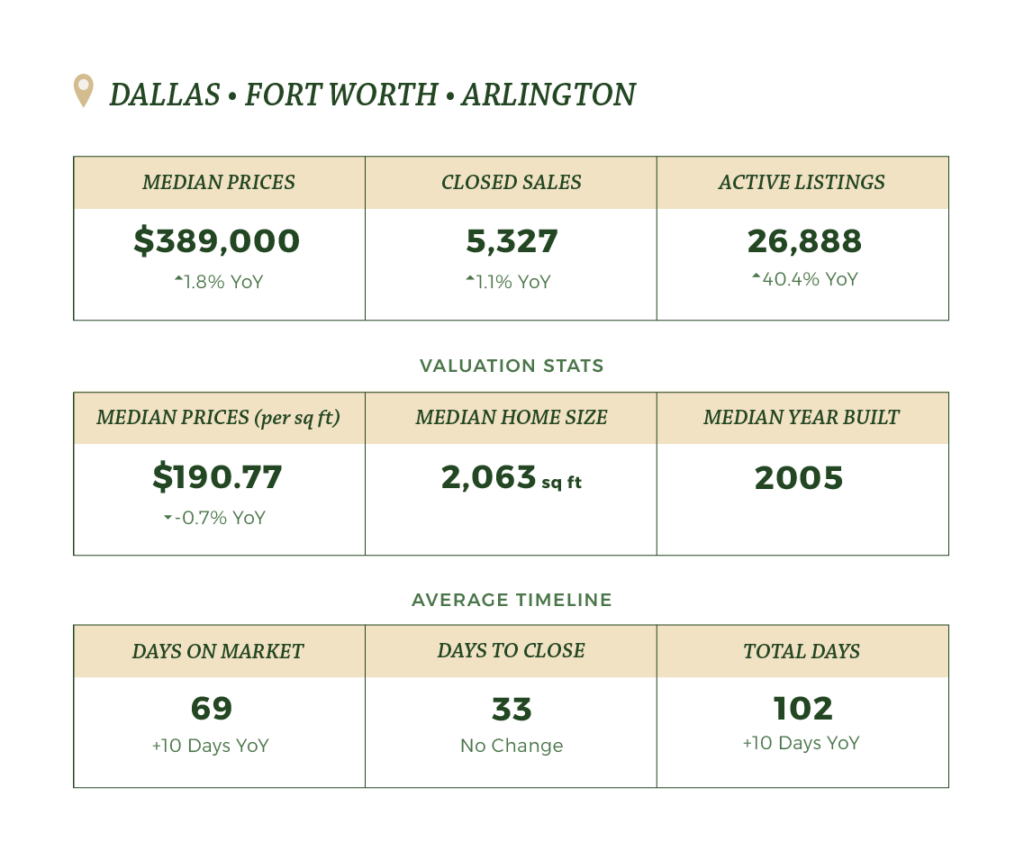

Dallas • Fort Worth • Arlington

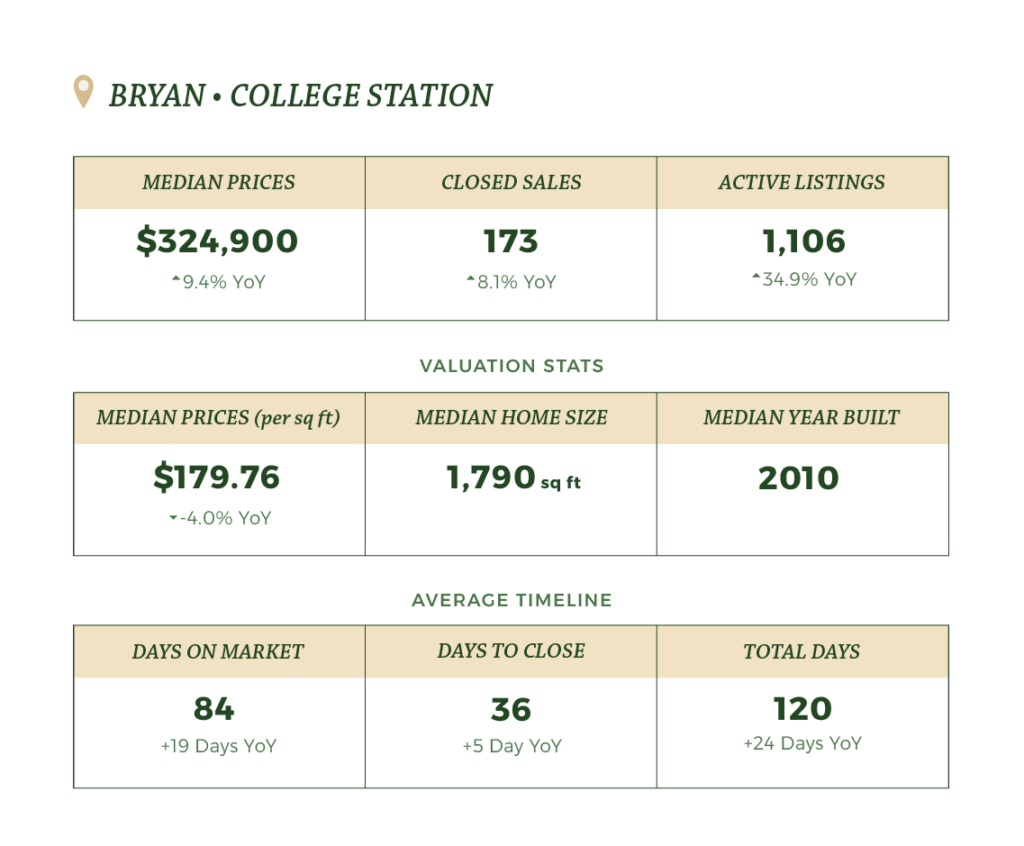

College Station • Bryan

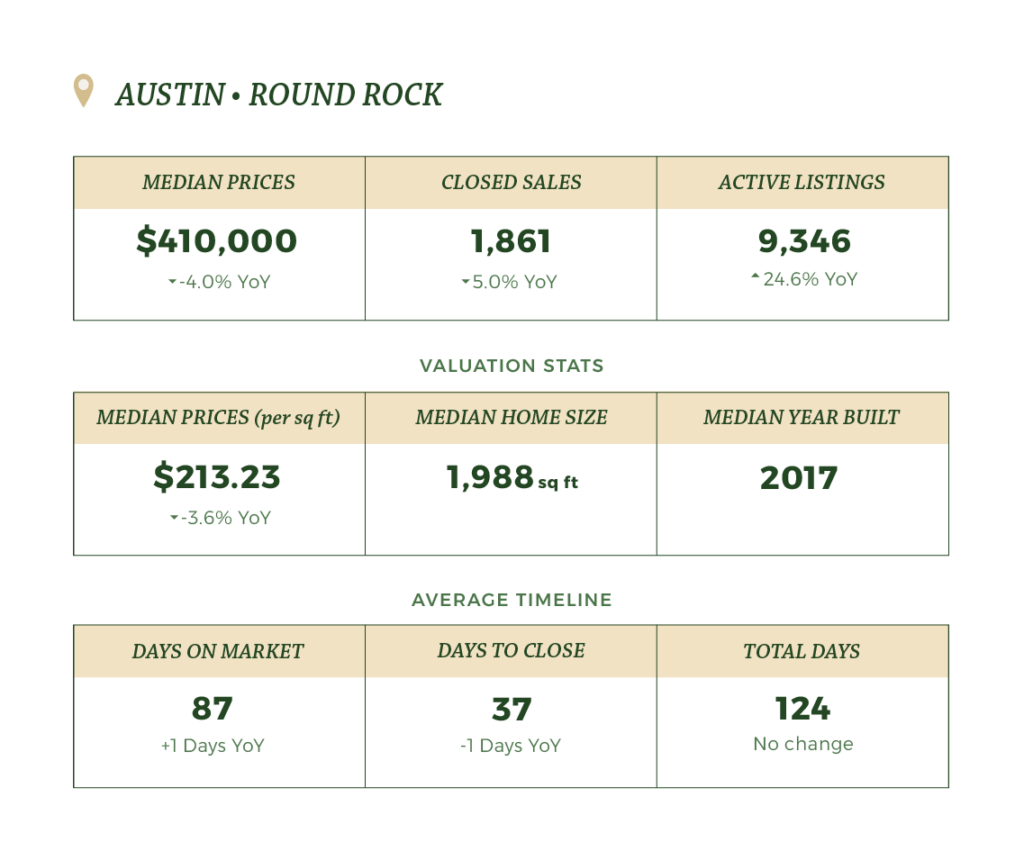

Austin • Round Rock

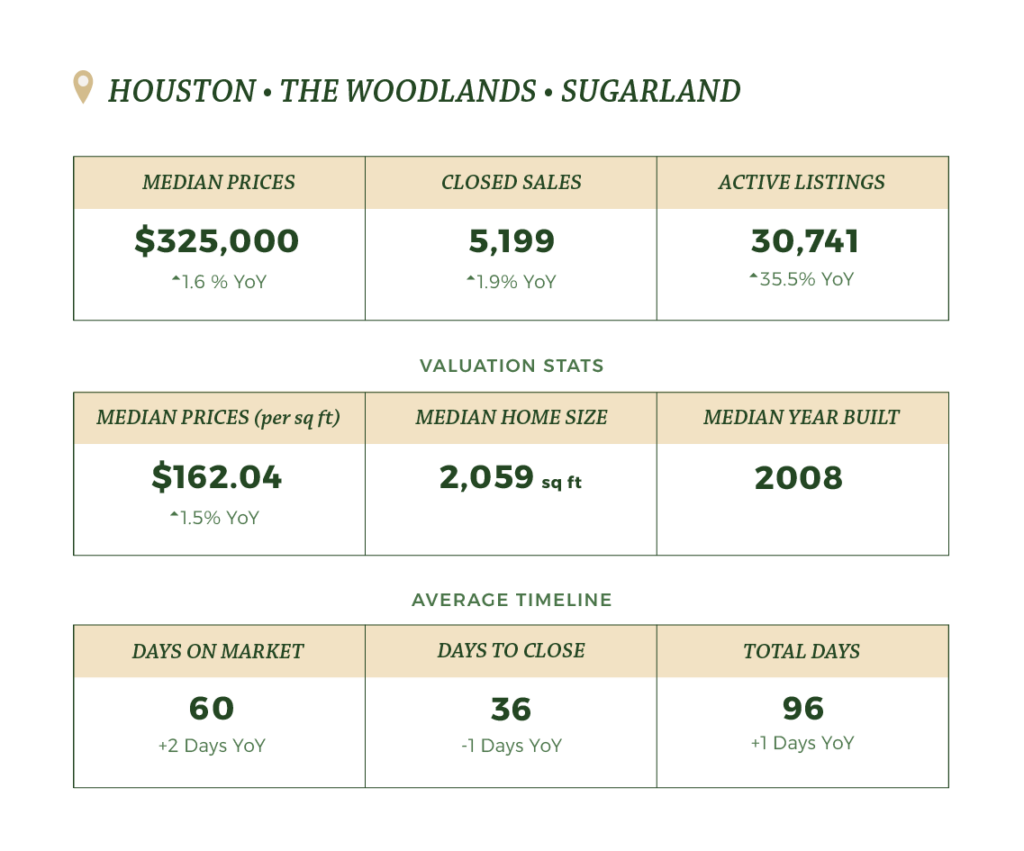

Houston • The Woodlands • Sugarland

Market Trends and Analysis

A common thread across all markets is the significant increase in available inventory, ranging from 24.6% to 40.4% year-over-year. This suggests a market that’s beginning to balance after years of tight inventory conditions. While prices remain stable or growing in most markets except Austin, the increased inventory and longer days on market indicate more negotiating power for buyers.

Another interesting observation is the consistent close-to-list price ratio across markets, hovering around 94%, suggesting realistic pricing strategies from sellers and stable negotiating conditions.

Looking ahead, these trends point toward a balanced market in 2025, with buyers benefiting from increased choice and slightly more favorable conditions, while sellers continue to see modest appreciation in most areas.

The DFW metroplex continues to show strength, with the median home price reaching $389,900, representing a 1.8% increase year-over-year. Closed sales saw a slight uptick of 1.1%, while active listings surged by 40.4% compared to last year, bringing months of inventory to 3.5 months. The median price per square foot stands at $190.77, with homes typically staying on the market for 69 days.

The Bryan-College Station market stands out with robust growth, showing a 9.4% increase in median price to $324,900. Closed sales increased by 8.1%, while active listings grew by 34.9%. The market now has 4.1 months of inventory, with properties spending an average of 84 days on market.

Austin’s market is showing signs of price correction, with the median home price declining 4% year-over-year to $410,000. Despite this, sales activity increased by 5%, and inventory levels rose to 3.6 months with active listings up 24.6%. The median price per square foot is $213.23, and homes are taking about 87 days to sell.

Houston’s market remains accessible with a median price of $325,000, up 1.6% from last year. The area saw a 1.9% increase in closed sales and a substantial 35.5% rise in active listings, pushing inventory levels to 4.3 months. Properties in Houston are spending about 60 days on market, with a median price per square foot of $162.04.

Learn More

The Texas Real Estate Research Center is a valuable resource for real estate professionals, investors, and anyone interested in learning more about the Texas real estate market.